Free guide

Solvency II Phase 2 Explained: Reporting Template Changes and New Requirements

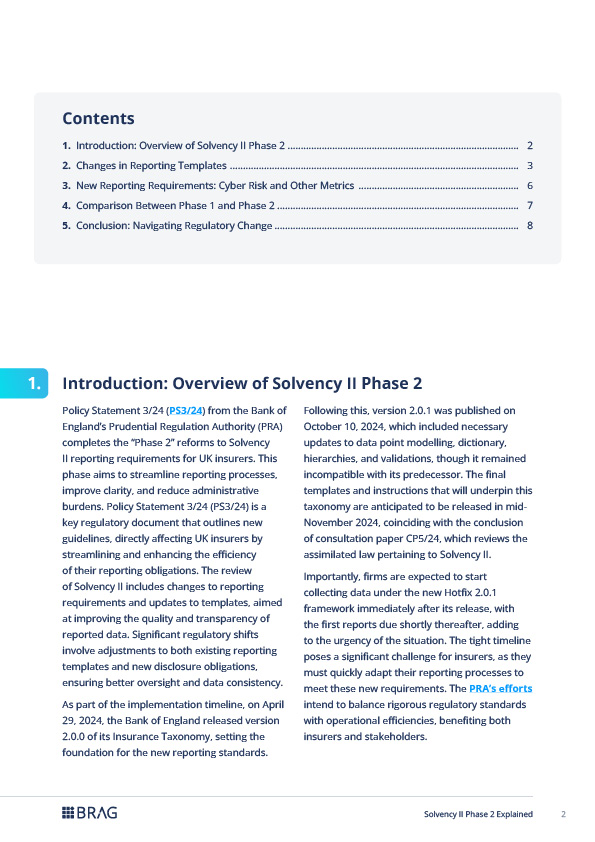

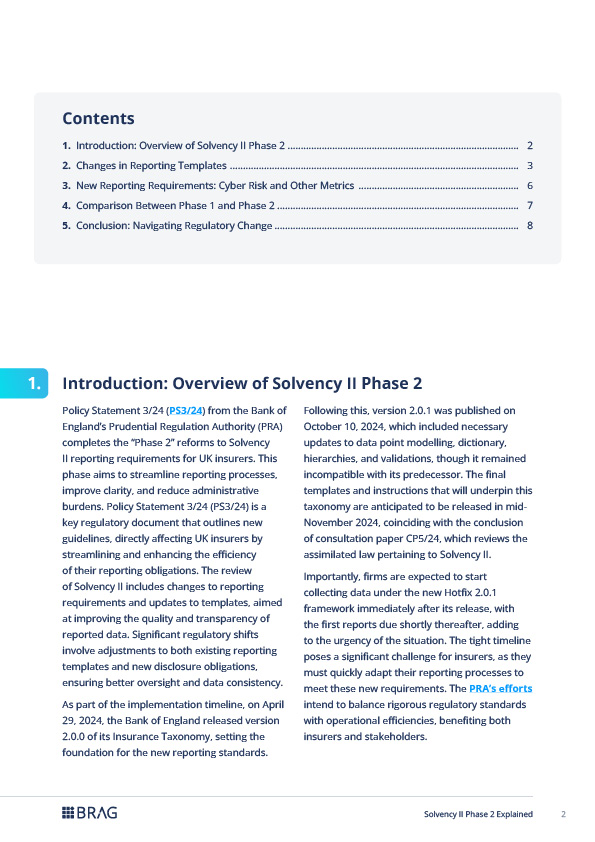

Policy Statement 3/24 (PS3/24) from the Bank of England’s Prudential Regulation Authority (PRA) finalizes the “Phase 2” reforms to Solvency II reporting requirements for UK insurers. Streamline your Solvency II reporting with our essential guide, filled with actionable insights on updated reporting templates and new disclosure requirements to help you stay compliant and boost reporting efficiency.

Free guide

Solvency II Phase 2 Explained: Reporting Template Changes and New Requirements

Policy Statement 3/24 (PS3/24) from the Bank of England’s Prudential Regulation Authority (PRA) finalizes the “Phase 2” reforms to Solvency II reporting requirements for UK insurers. Streamline your Solvency II reporting with our essential guide, filled with actionable insights on updated reporting templates and new disclosure requirements to help you stay compliant and boost reporting efficiency.

Get Your Firm Solvency II Compliant

Policy Statement 3/24 (PS3/24) introduces new guidelines that streamline and enhance reporting for UK insurers. As part of this reform, the Bank of England launched Insurance Taxonomy 2.0.0 on April 29, 2024, laying the groundwork for updated reporting standards. On October 10, 2024, version 2.0.1 followed, featuring crucial updates to data modeling, dictionaries, hierarchies, and validations—though it’s incompatible with the previous version.

Firms must adopt the Hotfix 2.0.1 framework immediately, with first reports due soon, emphasizing the need for swift action.

This guide provides expert insights on:

- Solvency II Phase 2 overview

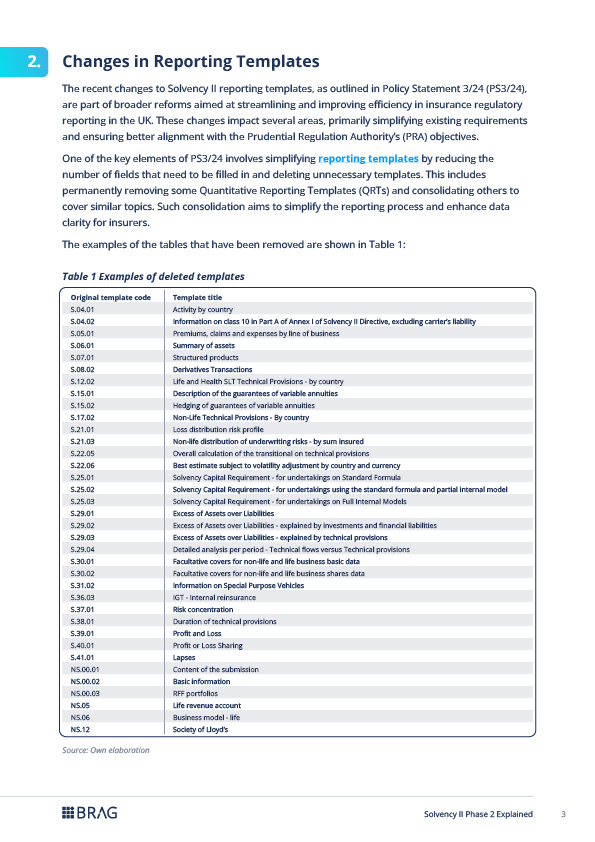

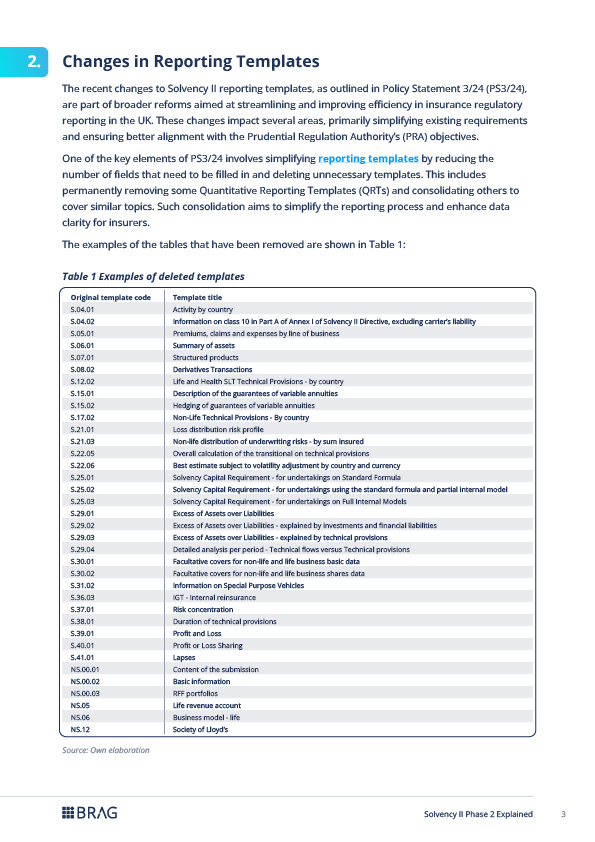

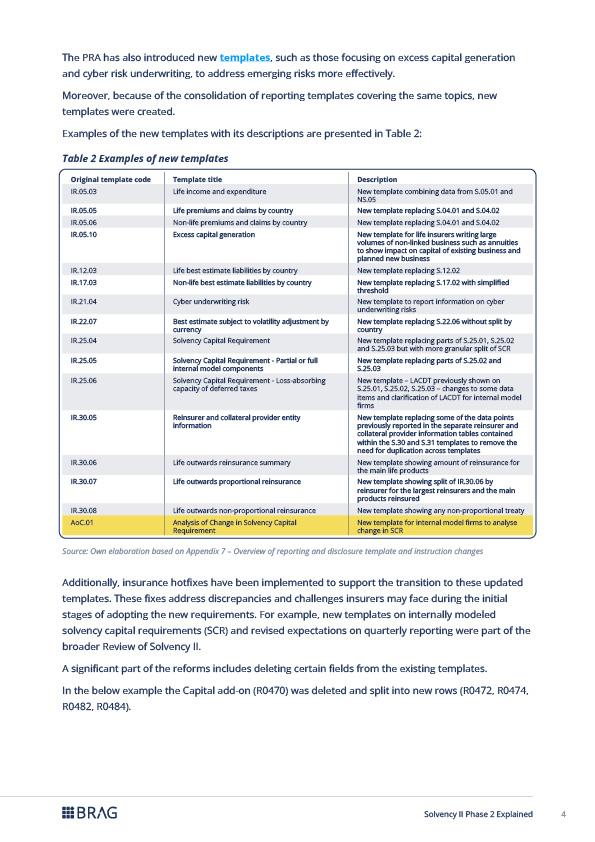

- Changes in reporting templates

- New metrics, including cyber risk reporting

- Key differences between Phase 1 and Phase 2

About author

Karolina Buzińska is a Business Analyst specializing in the insurance and banking sectors. With years of experience, she has made significant contributions to numerous high-impact regulatory compliance project, collaborating extensively with both government agencies and private enterprises. Karolina is a member of the team leading the implementation of the Insurance Hotfix 2.0.1 release. Her role involves leveraging our advanced validation tool, ATOME Particles, to ensure comprehensive testing and alignment with regulatory standards.

Karolina Buzińska is a Business Analyst specializing in the insurance and banking sectors. With years of experience, she has made significant contributions to numerous high-impact regulatory compliance project, collaborating extensively with both government agencies and private enterprises. Karolina is a member of the team leading the implementation of the Insurance Hotfix 2.0.1 release. Her role involves leveraging our advanced validation tool, ATOME Particles, to ensure comprehensive testing and alignment with regulatory standards.

We prioritize keeping your personal information secure. We collect it to:

- Personalize your browsing experience on our site

- Share relevant updates and resources via email or other channels

- Send marketing communications we believe will be valuable to you

You can opt out at any time. Learn more in our privacy policy.